I sold out my position of America Realty Capital Properties Inc. (ARCP)

231 shares @ $8.05 on 12/24/2014

I was actually going to hold on to this company even if they cut the divided by half, but I was not planning to add to it in the future. The reason why I sold is because they decided to suspend the dividend payments for the near future. That was the last strew for me.

Invested $3,020.26

Total Divided Received: $224.49

Amount after sell: $1,852.50

Not sure how I get my ROI. Maybe one of my readers can help me with that. :)

I think I got a ROI: -33.7%

I put this money right back to work. I will mention the two buys this month in my next post as well as my 2014 in review and 2015 Goals post.

Lesson learn here. Buy quality with history/track record.

Tuesday, December 30, 2014

Sunday, December 28, 2014

Dividend Income - November and December 2014

Sorry for not getting the November dividends post out, but here it is as well as Decembers.

November 2014 Dividends Received:

Realty Income Corp. (O) - $4.03

Deere & CO INC. (DE) - $16.80

American Rlty Cap. PPTYS (ARCP) - $19.25

Clorox Company (CLX) - $11.10

Kinder Morgan Inc (KMI) - $49.28

Procter & Gamble Company (PG) - $9.65

Caterpillar Inc (CAT) - $9.80

November 2014 Dividends Received:

Total dividends for the month of November: $119.91

December 2014 Dividends Received:

Realty Income Corp. (O) - $4.03

American Rlty Cap. PPTYS (ARCP) - $19.25

McDonald Corp (MCD) - $10.20

Chevron Corp (CVX) - $21.40

International Business Machines (IBM) - $6.60

Exxon Mobil Corp (XOM) - $8.97

Aflac Inc. (AFL) -$9.75

BP plc (BP) - $48.00

Target Corp (TGT) - $22.88

Ensco (ESV) - $63.00

Wells Fargo & Co. (WFC) - $9.80

The Coca-Cola Co. (KO) - $21.35

WOW I passed $200 in a single month for the first time. That right there can cover my total expense for my car.

December 2014 Dividends Received:

Total dividends for the month of December: $245.23

WOW I passed $200 in a single month for the first time. That right there can cover my total expense for my car.

One of my many Goals is to receive $2,000 in dividends for this year.

With this year dividend completed. I received a total of $1,614.61 of dividends. WOW!!

This put me at 80%. I did not reach my goal for total dividend for the year, but that's OK. As long as I am trying has hard as I can to save and invest the money, I will be heading in the right direction.

Don't forget to check out my Dividend Income page which shows the total income by month.

This month I also made a sell and two buys. Keep a look out for those posts as well as a 2014 in review and a 2015 goal.

Thanks for reading and commenting.

With this year dividend completed. I received a total of $1,614.61 of dividends. WOW!!

This put me at 80%. I did not reach my goal for total dividend for the year, but that's OK. As long as I am trying has hard as I can to save and invest the money, I will be heading in the right direction.

Don't forget to check out my Dividend Income page which shows the total income by month.

This month I also made a sell and two buys. Keep a look out for those posts as well as a 2014 in review and a 2015 goal.

Thanks for reading and commenting.

Tuesday, December 23, 2014

FRIP Purchase

I added more shares to my position of BP plc (ADR) (BP).

2 Share @ $36.57 on 1-9-2015

This increases my forward 12-month dividend income by $4.80 to a total of $2,137.04

I also updated my portfolio page to reflect the change.

What are you buying with dividends?

2 Share @ $36.57 on 1-9-2015

This increases my forward 12-month dividend income by $4.80 to a total of $2,137.04

I also updated my portfolio page to reflect the change.

What are you buying with dividends?

Monday, December 15, 2014

FRIP Purchase

I added more shares to my position of BP plc (ADR) (BP).

1 Share @ $35.11

This increases my forward 12-month dividend income by $2.40 to a total of $2,125.04

I also updated my portfolio page to reflect the change.

What are you buying with dividends?

1 Share @ $35.11

This increases my forward 12-month dividend income by $2.40 to a total of $2,125.04

I also updated my portfolio page to reflect the change.

What are you buying with dividends?

Wednesday, December 10, 2014

FRIP Purchase

I added more shares to my position of BP plc (ADR) (BP).

2 Share @ $37.53

This increases my forward 12-month dividend income by $4.80 to a total of $2,118.36

I also updated my portfolio page to reflect the change.

What are you buying with dividends?

2 Share @ $37.53

This increases my forward 12-month dividend income by $4.80 to a total of $2,118.36

I also updated my portfolio page to reflect the change.

What are you buying with dividends?

Tuesday, December 9, 2014

Trade - Buy

I add to a my position Toronto-Dominion Bank (TD)

26 Shares @ 47.58 on 12-5-2014

This will increase my forward 12-months dividend by $42.64 to a total of $2,113.56

I updated my Portfolio to reflect the change.

26 Shares @ 47.58 on 12-5-2014

This will increase my forward 12-months dividend by $42.64 to a total of $2,113.56

I updated my Portfolio to reflect the change.

My Last buy of TD was on October 10. Nothing really change. Here

They missed there EPS by $0.03.

Morningstar (***) Fair: $47.00

S&P Capital (****) Fair: $68.40

Like TD at this level? Do you own it?

S&P Capital (****) Fair: $68.40

Like TD at this level? Do you own it?

Monday, December 1, 2014

FRIP Purchase

I added more shares to my position of BP plc (ADR) (BP).

1 Share @ $39.52

This increases my forward 12-month dividend income by $2.40 to a total of $2,071.96

I also updated my portfolio page to reflect the change.

What are you buying with dividends?

1 Share @ $39.52

This increases my forward 12-month dividend income by $2.40 to a total of $2,071.96

I also updated my portfolio page to reflect the change.

What are you buying with dividends?

Friday, November 21, 2014

Trade - Buy

I added more shares to my position to International Business Machines Corp. (IBM)

7 shares @ $161.27 on 11-07-2014

This will increase my forward 12-months dividend by $7.70 to a total of $2,069.56

I updated my Portfolio to reflect the change.

Sorry for taking so long on posting this new buy.

Here we see that based on fast graphs that IBM is very under value.

5 year estimated return.

We see that IBM PE is lower then its own 5 year average. Also its forward PE is lower then its current PE.

Here we see that the dividend yield is at its highest point in the past 5 year.

Again sorry for the delayed post.Thanks for reading.

7 shares @ $161.27 on 11-07-2014

This will increase my forward 12-months dividend by $7.70 to a total of $2,069.56

I updated my Portfolio to reflect the change.

Sorry for taking so long on posting this new buy.

Here we see that based on fast graphs that IBM is very under value.

5 year estimated return.

We see that IBM PE is lower then its own 5 year average. Also its forward PE is lower then its current PE.

Here we see that the dividend yield is at its highest point in the past 5 year.

Again sorry for the delayed post.Thanks for reading.

Morningstar (****) Fair: $196.00

S&P Capital (***) Fair: $209.10

Like IBM at this level? Did you buy some? What did you buy?

S&P Capital (***) Fair: $209.10

Like IBM at this level? Did you buy some? What did you buy?

Monday, November 17, 2014

FRIP Purchase

I added more shares to my position of BP plc (BP).

1 Share @ $40.97 on 11-17-2014

This increases my forward 12-month dividend income by $2.40 to a total of $2,069.56

I also updated my portfolio page to reflect the change.

1 Share @ $40.97 on 11-17-2014

This increases my forward 12-month dividend income by $2.40 to a total of $2,069.56

I also updated my portfolio page to reflect the change.

Sunday, November 16, 2014

FRIP Purchase

I added more shares to my position of Ensco PLC (ESV).

1 Share @ $38.76 on 11-14-2014

This increases my forward 12-month dividend income by $3.00 to a total of $2,067.16

I also updated my portfolio page to reflect the change.

1 Share @ $38.76 on 11-14-2014

This increases my forward 12-month dividend income by $3.00 to a total of $2,067.16

I also updated my portfolio page to reflect the change.

Saturday, November 8, 2014

Dividend Income - October 2014

Once a month I will be updating the dividend that I received for that month.

October 2014 Dividends Received:

October 2014 Dividends Received:

- Realty Income Corp. (O) - $4.03

- American Rlty Cap. PPTYS (ARCP) - $19.25

- Baxter International (BAX) - $17.16

- Altria Group (MO) - $15.08

- Philip Morris Intl (PM) - $43.00

- General Electric Co (GE) - $23.54

- Cisco Systems (CSCO) - $5.51

- Coca Cola Co. (KO) - $21.35

Total dividends for the month of October: $148.92

One of my many Goals is to receive $2,000 in dividends for this year.

Right now my total for the year is $1,249.47. I am 62.5% complete on reaching my goal. I will not reach my dividend income goal but that is OK.

Also, don't forget to check out my Dividend Income page which shows the total income history.

Was October a good month for you?

One of my many Goals is to receive $2,000 in dividends for this year.

Right now my total for the year is $1,249.47. I am 62.5% complete on reaching my goal. I will not reach my dividend income goal but that is OK.

Also, don't forget to check out my Dividend Income page which shows the total income history.

Was October a good month for you?

Monday, November 3, 2014

FRIP Purchase

I added more shares to my position of Ensco PLC (ESV).

1 Share @ $40.90 on 11-03-2014

This increases my forward 12-month dividend income by $3.00 to a total of $2,033.36

I also updated my portfolio page to reflect the change.

1 Share @ $40.90 on 11-03-2014

This increases my forward 12-month dividend income by $3.00 to a total of $2,033.36

I also updated my portfolio page to reflect the change.

Thursday, October 30, 2014

Trade - Buy

I added more shares to my position to Ensco PLC (ESV)

30 shares @ $39.30 on 10-24-2014

This will increase my forward 12-months dividend by $90 to a total of $2,030.36

I updated my Portfolio to reflect the change.

30 shares @ $39.30 on 10-24-2014

This will increase my forward 12-months dividend by $90 to a total of $2,030.36

I updated my Portfolio to reflect the change.

Yayyy I passed forward dividend of $2k.

I continue to add to my position in ESV using scottrade FRIP.

Morningstar (***) Fair: $43.00

S&P Capital (***) Fair: $49.20

Like ESV at this level? Did you buy some?

S&P Capital (***) Fair: $49.20

Like ESV at this level? Did you buy some?

Monday, October 20, 2014

Trade - Buy

I add to a new position Toronto-Dominion Bank (TD)

26 Shares @ 48.20 on 10-10-2014

This will increase my forward 12-months dividend by $43.68 to a total of $1,931.96

I updated my Portfolio to reflect the change.

Here we see that earnings is higher then the price. Also notice that S&P Credit Rating is AA- and TD has no debt.

Here is a estimated total return on 17% in 5 years.

Here we see that TD is undervalue based on its 5 year average. Forward PE is lower then its current PE.

Here we see that the dividend yield is at a high point. To me this means a buy base on this 5 year graph of its divided yield.

Morningstar (***) Fair: $47.00

S&P Capital (****) Fair: $57.90

Like TD at this level? Do you own it?

26 Shares @ 48.20 on 10-10-2014

This will increase my forward 12-months dividend by $43.68 to a total of $1,931.96

I updated my Portfolio to reflect the change.

Here we see that earnings is higher then the price. Also notice that S&P Credit Rating is AA- and TD has no debt.

Here is a estimated total return on 17% in 5 years.

Here we see that TD is undervalue based on its 5 year average. Forward PE is lower then its current PE.

Here we see that the dividend yield is at a high point. To me this means a buy base on this 5 year graph of its divided yield.

S&P Capital (****) Fair: $57.90

Like TD at this level? Do you own it?

Thursday, October 16, 2014

FRIP Purchase

I added more shares to my position of Ensco PLC (ESV).

1 Share @ $37.32 on 10-15-2014

This increases my forward 12-month dividend income by $3.00 to a total of $1,927.48

I also updated my portfolio page to reflect the change.

1 Share @ $37.32 on 10-15-2014

This increases my forward 12-month dividend income by $3.00 to a total of $1,927.48

I also updated my portfolio page to reflect the change.

Friday, October 10, 2014

FRIP Purchase

I added more shares to my position of Ensco PLC (ESV).

1 Share @ $37.59 on 10-10-2014

This increases my forward 12-month dividend income by $3.00 to a total of $1,924.48

I also updated my portfolio page to reflect the change.

1 Share @ $37.59 on 10-10-2014

This increases my forward 12-month dividend income by $3.00 to a total of $1,924.48

I also updated my portfolio page to reflect the change.

Wednesday, October 8, 2014

Dividend Income - September 2014

Once a month I will be updating the dividend that I received for that month.

September 2014 Dividends Received:

Realty Income Corp. (O) - $4.02

American Rlty Cap. PPTYS (ARCP) - $19.25

McDonald Corp (MCD) - $9.72

Chevron Corp (CVX) - $21.40

International Business Machines (IBM) - $6.60

Exxon Mobil Corp (XOM) - $8.97

Aflac Inc. (AFL) -$9.25

BP plc (BP) - $31.59

Target Corp (TGT) - $22.88

Ensco (ESV) - $34.50

Wells Fargo & Co. (WFC) - $0.35

Wal-Mart Stores (WMT) - $7.68

September 2014 Dividends Received:

Total dividends for the month of September: $176.21

My goal this year was to receive $2000 in dividends. With this month dividends I received $1,100.55 for the year so far. This give me a percentage of 55% completed for my goal. Since there is only three months left in the year, I have no chance of passing my goal. However, I am looking forward to December dividend income because I will pass $200 for the first time. Can't wait to see that.

You can check out the dividend progress Here.

Had a good month? Hope you did.

My goal this year was to receive $2000 in dividends. With this month dividends I received $1,100.55 for the year so far. This give me a percentage of 55% completed for my goal. Since there is only three months left in the year, I have no chance of passing my goal. However, I am looking forward to December dividend income because I will pass $200 for the first time. Can't wait to see that.

You can check out the dividend progress Here.

Had a good month? Hope you did.

Thursday, October 2, 2014

FRIP Purchase

I added more shares to my position of Ensco PLC (ESV).

1 Share @ $38.49 on 10-2-2014

This increases my forward 12-month dividend income by $3.00 to a total of $1,877.80

I also updated my portfolio page to reflect the change.

1 Share @ $38.49 on 10-2-2014

This increases my forward 12-month dividend income by $3.00 to a total of $1,877.80

I also updated my portfolio page to reflect the change.

Tuesday, September 23, 2014

FRIP Purchase

I added more shares to my position of Ensco PLC (ESV).

1 Share @ $43.56 on 9-23-2014

This increases my forward 12-month dividend income by $3.00 to a total of $1,874.80

I also updated my portfolio page to reflect the change.

1 Share @ $43.56 on 9-23-2014

This increases my forward 12-month dividend income by $3.00 to a total of $1,874.80

I also updated my portfolio page to reflect the change.

Tuesday, September 16, 2014

Trade - Buy

I added more shares to my position to BP plc (ADR) (BP)

26 shares @ $45.97 on 9-12-2014

This will increase my forward 12-months dividend by $60.32 to a total of $1,869.88

I updated my Portfolio to reflect the change.

Here we see that BP forward PE is very low at 5.6

Here we see that current yield is at is 5 year highest.

Morningstar (****) Fair: $59.00

S&P Capital (****) Fair: $46.50

Like BP at this level? Did you buy some?

26 shares @ $45.97 on 9-12-2014

This will increase my forward 12-months dividend by $60.32 to a total of $1,869.88

I updated my Portfolio to reflect the change.

Here we see that BP forward PE is very low at 5.6

Here we see that current yield is at is 5 year highest.

Morningstar (****) Fair: $59.00

S&P Capital (****) Fair: $46.50

Like BP at this level? Did you buy some?

Monday, September 15, 2014

FRIP Purchase

I added more shares to my position of Ensco PLC (ESV).

1 Share @ $45.96 on 9-15-2014

This increases my forward 12-month dividend income by $3.00 to a total of $1,869.88

I also updated my portfolio page to reflect the change.

1 Share @ $45.96 on 9-15-2014

This increases my forward 12-month dividend income by $3.00 to a total of $1,869.88

I also updated my portfolio page to reflect the change.

Wednesday, September 10, 2014

FRIP Purchase

I added more shares to my position of Ensco PLC (ESV).

1 Share @ $47.22 on 9-10-2014

This increases my forward 12-month dividend income by $3.00 to a total of $1,796.24

I also updated my portfolio page to reflect the change.

1 Share @ $47.22 on 9-10-2014

This increases my forward 12-month dividend income by $3.00 to a total of $1,796.24

I also updated my portfolio page to reflect the change.

Monday, September 8, 2014

Dividend Income - August 2014

Once a month I will be updating the dividend that I received for that month.

August 2014 Dividends Received:

Realty Income Corp. (O) - $4.02

Deere & CO INC. (DE) - $7.80

American Rlty Cap. PPTYS (ARCP) - $19.25

Clorox Company (CLX) - $11.10

Kinder Morgan Inc (KMI) - $48.16

Procter & Gamble Company (PG) - $9.65

Caterpillar Inc (CAT) - $9.80

One of my many Goals is to receive $2,000 in dividends for this year.

I am 46% complete in reaching my goal. At this rate it looks like I will not make this goal I set out for myself. That's OK.

Also, don't forget to check out my Dividend Income page which shows the total income by month.

Was August a good month for you?

August 2014 Dividends Received:

Total dividends for the month of August: $109.78

One of my many Goals is to receive $2,000 in dividends for this year.

I am 46% complete in reaching my goal. At this rate it looks like I will not make this goal I set out for myself. That's OK.

Also, don't forget to check out my Dividend Income page which shows the total income by month.

Was August a good month for you?

Tuesday, September 2, 2014

FRIP Purchase

I added more shares to my position of Ensco PLC (ESV).

1 Share @ $48.89 on 9-2-2014

This increases my forward 12-month dividend income by $3.00 to a total of $1,793.24

I also updated my portfolio page to reflect the change.

1 Share @ $48.89 on 9-2-2014

This increases my forward 12-month dividend income by $3.00 to a total of $1,793.24

I also updated my portfolio page to reflect the change.

Monday, September 1, 2014

Trade - Buy

I added more shares to my position to General Electric Company (GE)

49 shares @ $25.98 on 8-29-2014

This will increase my forward 12-months dividend by $43.12 to a total of $1,790.24

I updated my Portfolio to reflect the change.

Morningstar (***) Fair: $29.00

S&P Capital (****) Fair: $27.00

Like GE at this level?

49 shares @ $25.98 on 8-29-2014

This will increase my forward 12-months dividend by $43.12 to a total of $1,790.24

I updated my Portfolio to reflect the change.

Morningstar (***) Fair: $29.00

S&P Capital (****) Fair: $27.00

Like GE at this level?

Saturday, August 30, 2014

Goal Reached

I am happy to announce that I reached my net worth goal of $70k yesterday. I actually did not think I was going to make that goal this year. However, not only did I make it, but I am going to surpass it by a wide margin.

I use mint to keep track of all my accounts. I love that website.

Here we have all my assets and debts.

I love the way this graph looks. Just need to work on getting rid of my debts. I started investing and saving on Aug 2013. You can see how at that point my net worth has been taking off.

Here we have all my assets and debts.

I love the way this graph looks. Just need to work on getting rid of my debts. I started investing and saving on Aug 2013. You can see how at that point my net worth has been taking off.

Since I reached this goal. I am going to put a new goal for my net worth. By the end of the year I want to pass $80k, I think I have a good shot as long I continue to save/invest as well as pay down the debt.

You can check out my other goals Here. I also updated it with the new goal.

Thank you to all my readers for the support and comments.

Saturday, August 23, 2014

Trade - Buy

I added more shares to my position to Wells Fargo & Co (WFC)

25 shares @ $50.50 on 8-15-2014

This will increase my forward 12-months dividend by $35 to a total of $1,742.48

I updated my Portfolio to reflect the change.

25 shares @ $50.50 on 8-15-2014

This will increase my forward 12-months dividend by $35 to a total of $1,742.48

I updated my Portfolio to reflect the change.

Morningstar (***) Fair: $50.00

S&P Capital (***) Fair: $53.70

What do you think of WFC at theses prices?

Friday, August 8, 2014

FRIP Purchase

I added more shares to my position of Wells Fargo & Co (WFC).

1 Share @ $49.88 on 8-8-2014

This increases my forward 12-month dividend income by $1.40 to a total of $1,706.08

I also updated my portfolio page to reflect the change.

1 Share @ $49.88 on 8-8-2014

This increases my forward 12-month dividend income by $1.40 to a total of $1,706.08

I also updated my portfolio page to reflect the change.

Friday, August 1, 2014

Trade - Buy

I added more shares to my position to Deere & Company (DE)

15 shares @ $85.10 on 8-1-2014

This will increase my forward 12-months dividend by $36 to a total of $1,704.68

I updated my Portfolio to reflect the change.

Here we see that DE is very much undervalue. We also see that projected EPS is on a downtrend. I am not worry about this because people got to eat. Therefore farmers will need DE.

15 shares @ $85.10 on 8-1-2014

This will increase my forward 12-months dividend by $36 to a total of $1,704.68

I updated my Portfolio to reflect the change.

Here we see that DE is very much undervalue. We also see that projected EPS is on a downtrend. I am not worry about this because people got to eat. Therefore farmers will need DE.

Here is a 5 year graph.

Here we have a 5 year est. tot. ret. of 12.6%

This shows us that DE is oversold with its RSI at 29.

Here we show that the 5 year yield is at the highest point right now.

Here we have the dividend growth.

Morningstar (***) Fair: $95.00

S&P Capital (**) Fair $105.50:

What do you think of DE?

Tuesday, July 15, 2014

Trade - Buy

Sorry everyone. I been really busy traveling for work and on vacation. I had no time to update my blog.

This will be a quick post

I added to my position with Target Corporation (TGT).

21 shares @ $58.97 on 7/3/2014

I also did some FIRP purchases for TGT

1 share @ $57.12 on 6/13/2014

1 share @ $58.07 on 6/25/2014

1 share @ $59.81 on 7/11/2014

I have a total of 44 shares of TGT.

Once I get back to my normal life I will making better posts. Thanks for reading.

This will be a quick post

I added to my position with Target Corporation (TGT).

21 shares @ $58.97 on 7/3/2014

I also did some FIRP purchases for TGT

1 share @ $57.12 on 6/13/2014

1 share @ $58.07 on 6/25/2014

1 share @ $59.81 on 7/11/2014

I have a total of 44 shares of TGT.

Once I get back to my normal life I will making better posts. Thanks for reading.

Monday, June 30, 2014

Dividend Income - June 2014

Once a month I will be updating the dividend that I received for that month.

June 2014 Dividends Received:

Realty Income Corp. (O) - $4.01

American Rlty Cap. PPTYS (ARCP) - $19.25

McDonald Corp (MCD) - $9.72

Chevron Corp (CVX) - $21.40

International Business Machines (IBM) - $6.60

Exxon Mobil Corp (XOM) - $8.97

Aflac Inc. (AFL) -$9.25

BP plc (BP) - $31.59

Target Corp (TGT) - $8.60

Ensco (ESV) - $33.75

Wal-Mart Stores (WMT) - $7.68

June 2014 Dividends Received:

Total dividends for the month of June: $160.82

My goal this year is to receive $2000 in dividends. I am 34% done with that goal.

You can check out the dividend progress Here.

Had a good month?

My goal this year is to receive $2000 in dividends. I am 34% done with that goal.

You can check out the dividend progress Here.

Had a good month?

Tuesday, June 24, 2014

Trade - Buy

I added a new company to my portfolio. I purchased shares of Deere & Company (DE)

13 shares @ $91.48 on 6-6-2014

Sorry for taking so long to update this buy. I been really busy. I just wanted to get this quick update posted.

Thanks everyone for reading my blog.

13 shares @ $91.48 on 6-6-2014

Sorry for taking so long to update this buy. I been really busy. I just wanted to get this quick update posted.

Thanks everyone for reading my blog.

Tuesday, June 3, 2014

FRIP Purchase

I added more shares to my position of Kinder Morgan Inc. (KMI).

1 Share @ $33.72 on 6-2-2014

This increases my forward 12-month dividend income by $1.68 to a total of $1,568.88

I also updated my portfolio page to reflect the change.

1 Share @ $33.72 on 6-2-2014

This increases my forward 12-month dividend income by $1.68 to a total of $1,568.88

I also updated my portfolio page to reflect the change.

Monday, June 2, 2014

Dividend Income - May 2014

Once a month I will be updating the dividend that I received for that month.

May 2014 Dividends Received:

Realty Income Corp. (O) - $4.01

American Rlty Cap. PPTYS (ARCP) - $10.83

Clorox Company (CLX) - $10.65

Kinder Morgan Inc (KMI) - $45.78

Procter & Gamble Company (PG) - $9.65

Caterpillar Inc (CAT) - $8.40

One of my many Goals is to receive $2,000 in dividends for this year.

I am 26% complete in reaching my goal. I hope you guys continue to follow my blog and cheer me on to hit is goal of mine.

All of the income that I'm receiving from dividends are all being reinvested. I'm currently reinvesting it all into KMI.

Also, don't forget to check out my Dividend Income page which shows the total income by month.

Was May a good month for you?

May 2014 Dividends Received:

Total dividends for the month of May: $89.32

One of my many Goals is to receive $2,000 in dividends for this year.

I am 26% complete in reaching my goal. I hope you guys continue to follow my blog and cheer me on to hit is goal of mine.

All of the income that I'm receiving from dividends are all being reinvested. I'm currently reinvesting it all into KMI.

Also, don't forget to check out my Dividend Income page which shows the total income by month.

Was May a good month for you?

Monday, May 19, 2014

FRIP Purchase

I added more shares to my position of Kinder Morgan Inc. (KMI).

1 Share @ $33.31 on 4-19-2014

This increases my forward 12-month dividend income by $1.68 to a total of $1,567.20

I also updated my portfolio page to reflect the change.

1 Share @ $33.31 on 4-19-2014

This increases my forward 12-month dividend income by $1.68 to a total of $1,567.20

I also updated my portfolio page to reflect the change.

Thursday, May 15, 2014

FRIP Purchase

I added more shares to my position of Kinder Morgan Inc. (KMI).

1 Share @ $33.41 on 4-15-2014

This increases my forward 12-month dividend income by $1.68 to a total of $1,565.52

I also updated my portfolio page to reflect the change.

1 Share @ $33.41 on 4-15-2014

This increases my forward 12-month dividend income by $1.68 to a total of $1,565.52

I also updated my portfolio page to reflect the change.

Monday, May 12, 2014

Trade - Buy

I added more shares to my position to American Realty Capital Properties (ARCP)

101 shares @ 12.77 on 5-9-2014

This will increase my forward 12-months dividend by $100.60 to a total of $1552.04

I updated my Portfolio to reflect the change.

I brought theses shares just in time. That same day ARCP had a 2% pop. Today it is up 1.73% as of this writing, so yes I brought it just in time.

This graph shows Funds From Operations (FFO). When looking at REITs, EPS is not what we look at. What needs to be looked at is FFO. As we can see here ARCP is very much undervalue base on FFO.

This shows that in 5 years there will be about a 61.1% return.

This shows that my $3,000 that I currently have invested will be worth $13k in 10 years.

101 shares @ 12.77 on 5-9-2014

This will increase my forward 12-months dividend by $100.60 to a total of $1552.04

I updated my Portfolio to reflect the change.

I brought theses shares just in time. That same day ARCP had a 2% pop. Today it is up 1.73% as of this writing, so yes I brought it just in time.

This graph shows Funds From Operations (FFO). When looking at REITs, EPS is not what we look at. What needs to be looked at is FFO. As we can see here ARCP is very much undervalue base on FFO.

This shows that my $3,000 that I currently have invested will be worth $13k in 10 years.

Here is a good read on ARCP: Why does Mr. Market fear American Realty Capital Properties

What do you think of ARCP?

Monday, April 28, 2014

Dividend Income - April 2014

Once a month I will be updating the dividend that I received for that month.

April 2014 Dividends Received:

April 2014 Dividends Received:

- Realty Income Corp. (O) - $4.01

- American Rlty Cap. PPTYS (ARCP) - $10.58

- Wal-Mart Stores (WMT) - $7.68

- Baxter International (BAX) - $16.17

- Altria Group (MO) - $13.92

- Philip Morris Intl (PM) - $40.42

- General Electric Co (GE) - $12.76

- Cisco Systems (CSCO) - $5.51

- Coca Cola Co. (KO) - $10.98

Total dividends for the month of April: $122.03

One of my many Goals is to receive $2,000 in dividends for this year.

Right now my total for the year is $430.03. I am 21.5% complete on reaching my goal. I need to start adding more capital if I want to reach this goal of mine.

Also, don't forget to check out my Dividend Income page which shows the total income history.

Was April a good month for you?

One of my many Goals is to receive $2,000 in dividends for this year.

Right now my total for the year is $430.03. I am 21.5% complete on reaching my goal. I need to start adding more capital if I want to reach this goal of mine.

Also, don't forget to check out my Dividend Income page which shows the total income history.

Was April a good month for you?

Friday, April 25, 2014

FRIP Purchase

I added more shares to my position of American Realty Capital Properties Inc. (ARCP).

1 Share @ $13.01 on 4-25-2014

This increases my forward 12-month dividend income by $1.00 to a total of $1,446.64

I also updated my portfolio page to reflect the change.

1 Share @ $13.01 on 4-25-2014

This increases my forward 12-month dividend income by $1.00 to a total of $1,446.64

I also updated my portfolio page to reflect the change.

Monday, April 21, 2014

FRIP Purchase

I added more shares to my position of American Realty Capital Properties Inc. (ARCP).

2 Share @ $13.38 on 4-21-2014

This increases my forward 12-month dividend income by $1.99 to a total of $1,445.68

I also updated my portfolio page to reflect the change.

2 Share @ $13.38 on 4-21-2014

This increases my forward 12-month dividend income by $1.99 to a total of $1,445.68

I also updated my portfolio page to reflect the change.

Thursday, April 17, 2014

401K/Roth IRA Portfolio Update 2014 Q1

At the end of every quarter I will update my 401K and Roth IRA performance. The History of my two portfolio can be found Here.

Here we have my 401K.

Here we can see how my Roth IRA portfolio has been doing.

I love the direction that both portfolio are heading.

Hows your Retirement accounts going?

Here we have my 401K.

Here we can see how my 401k portfolio has been doing.

Here we have my Roth IRA

Here we can see how my Roth IRA portfolio has been doing.

I love the direction that both portfolio are heading.

Hows your Retirement accounts going?

Monday, April 14, 2014

Trade - Buy

I added more shares to Kinder Morgan Inc. (KMI)

41 shares @ 32.70 on 4-11-2014

This will increase my forward 12-months dividend by $67.24 to a total of $1439.40

I updated my Portfolio to reflect the change.

Here we see KMI Valuation from Morningstar. We also see that KMI is undervalue compared to Industry P/E Avg. Another item I like to look at is Forward P/E which is 15.6. This is below current P/E of 28.1 which is a good thing. The PEG Ratio is very low which tells us that it is undervalue.

Here are some quote from a S&P Capital IQ report that shows why I keep investing in KMI. This Analysis was done on Dec 16, 2013

Morningstar (***) Fair: $34.00

S&P Capital IQ (****) Fair: $30.50

Like KMI?

41 shares @ 32.70 on 4-11-2014

This will increase my forward 12-months dividend by $67.24 to a total of $1439.40

I updated my Portfolio to reflect the change.

Here we see KMI Valuation from Morningstar. We also see that KMI is undervalue compared to Industry P/E Avg. Another item I like to look at is Forward P/E which is 15.6. This is below current P/E of 28.1 which is a good thing. The PEG Ratio is very low which tells us that it is undervalue.

Here are some quote from a S&P Capital IQ report that shows why I keep investing in KMI. This Analysis was done on Dec 16, 2013

Morningstar (***) Fair: $34.00

S&P Capital IQ (****) Fair: $30.50

Like KMI?

FRIP Purchase

I added more shares to my position of Kinder Morgan Inc. (KMI).

2 Share @ $32.29 on 4-11-2014

This increases my forward 12-month dividend income by $3.28 to a total of $1,439.40

I also updated my portfolio page to reflect the change.

2 Share @ $32.29 on 4-11-2014

This increases my forward 12-month dividend income by $3.28 to a total of $1,439.40

I also updated my portfolio page to reflect the change.

Tuesday, April 1, 2014

FRIP Purchase

I added more shares to my position of Kinder Morgan Inc. (KMI).

1 Share @ $32.77

This increases my forward 12-month dividend income by $1.64 to a total of $1,366.48

I also updated my portfolio page to reflect the change.

What are you buying with dividends?

1 Share @ $32.77

This increases my forward 12-month dividend income by $1.64 to a total of $1,366.48

I also updated my portfolio page to reflect the change.

What are you buying with dividends?

Friday, March 28, 2014

Dividend Income - March 2014

Once a month I will be updating the dividend that I received for that month.

March 2014 Dividends Received:

Realty Income Corp. (O) - $4.01

American Rlty Cap. PPTYS (ARCP) - $10.58

McDonald Corp (MCD) - $9.72

Chevron Corp (CVX) - $10.00

International Business Machines (IBM) - $5.70

Exxon Mobil Corp (XOM) - $8.19

Aflac Inc. (AFL) -$9.25

BP plc (BP) - $30.78

Target Corp (TGT) - $8.60

Ensco (ESV) - $33.75

One of my many Goals is to receive $2,000 in dividends for this year.

My total for the year so far is $308.00. This makes me 15.4% complete in reaching my goal. This goal of $2k of dividends looks like it will be a tough one.

I believe the best dividend anyone can receive is investing in oneself.

I am currently studying for Cisco Certified Network Associate Security (CCNA Security). I will take the test by the end of April. This will very much help me to pass my goal for $2k in dividends for the year because I would be investing about $2,400 easy every month or more.

All of the income that I'm receiving from dividends are all being reinvested. I'm currently reinvesting it all into KMI.

Also, don't forget to check out my Dividend Income page which shows the total income by month as well as a chart with the progress.

Thank you for reading

Was March a good month for you? I bet it was.

March 2014 Dividends Received:

Total dividends for the month of March: $130.58

This is the first time I passed the $100 mark. I am very happy with the progress so far. Next mark is $200 for a month. Can't wait to hit that one.

This is the first time I passed the $100 mark. I am very happy with the progress so far. Next mark is $200 for a month. Can't wait to hit that one.

One of my many Goals is to receive $2,000 in dividends for this year.

My total for the year so far is $308.00. This makes me 15.4% complete in reaching my goal. This goal of $2k of dividends looks like it will be a tough one.

I believe the best dividend anyone can receive is investing in oneself.

I am currently studying for Cisco Certified Network Associate Security (CCNA Security). I will take the test by the end of April. This will very much help me to pass my goal for $2k in dividends for the year because I would be investing about $2,400 easy every month or more.

All of the income that I'm receiving from dividends are all being reinvested. I'm currently reinvesting it all into KMI.

Also, don't forget to check out my Dividend Income page which shows the total income by month as well as a chart with the progress.

Thank you for reading

Was March a good month for you? I bet it was.

Tuesday, March 25, 2014

FRIP Purchase

I added more shares to my position of Kinder Morgan Inc. (KMI).

1 Share @ $31.61

This increases my forward 12-month dividend income by $1.64 to a total of $1,364.84

I also updated my portfolio page to reflect the change.

What are you buying with dividends?

1 Share @ $31.61

This increases my forward 12-month dividend income by $1.64 to a total of $1,364.84

I also updated my portfolio page to reflect the change.

What are you buying with dividends?

Monday, March 17, 2014

Trade - Buy

I added more shares to The Coca-Cola Company (KO)

34 shares @ 38.10 on 3-14-2014

This will increase my forward 12-months dividend by $42.16 to a total of $1363.20

I updated my Portfolio to reflect the change.

Here you can see that KO is overvalue base on earnings, but KO always sell at a premium. Base on the blue normal PE line, the current price is undervalue.

Here is a 5 year graph.This shows that the time to buy would be when the price gets under the blue normal PE line.

Here we have a comparison of price and dividend yield over the past 5 years. We see here that the current yield of 3.20% is at its highest since mid 2010. This tells me that KO is undervalue at this current price base on history yield.

Here we have the dividend history of KO. This is what we dividend investors like to see. Every year there is a increase of dividends.

Morningstar (****) Fair: $44.00

S&P Capital IQ (***) Fair: $ 33.50

Do you like KO at its current prices? Have shares of KO yourself?

34 shares @ 38.10 on 3-14-2014

This will increase my forward 12-months dividend by $42.16 to a total of $1363.20

I updated my Portfolio to reflect the change.

Here you can see that KO is overvalue base on earnings, but KO always sell at a premium. Base on the blue normal PE line, the current price is undervalue.

Here is a 5 year graph.This shows that the time to buy would be when the price gets under the blue normal PE line.

Here we have a comparison of price and dividend yield over the past 5 years. We see here that the current yield of 3.20% is at its highest since mid 2010. This tells me that KO is undervalue at this current price base on history yield.

Here we have the dividend history of KO. This is what we dividend investors like to see. Every year there is a increase of dividends.

Morningstar (****) Fair: $44.00

S&P Capital IQ (***) Fair: $ 33.50

Do you like KO at its current prices? Have shares of KO yourself?

Friday, March 14, 2014

FRIP Purchase

I added more shares to my position of Kinder Morgan Inc. (KMI).

1 Share @ $31.78

This increases my forward 12-month dividend income by $1.64 to a total of $1,363.20

I also updated my portfolio page to reflect the change.

What are you saving your dividends for?

1 Share @ $31.78

This increases my forward 12-month dividend income by $1.64 to a total of $1,363.20

I also updated my portfolio page to reflect the change.

What are you saving your dividends for?

Monday, March 10, 2014

FRIP Purchase

I added more shares to my position of Kinder Morgan Inc. (KMI).

1 Share @ $31.78

This increases my forward 12-month dividend income by $1.64 to a total of $1,319.40

I also updated my portfolio page to reflect the change.

What are you buying with your dividends?

1 Share @ $31.78

This increases my forward 12-month dividend income by $1.64 to a total of $1,319.40

I also updated my portfolio page to reflect the change.

What are you buying with your dividends?

Tuesday, February 25, 2014

Dividend Income - February 2014

Once a month I will be updating the dividend that I received for that month.

February 2014 Dividends Received:

Realty Income Corp. (O) - $4.01

American Rlty Cap. PPTYS (ARCP) - $20.88

Clorox Company (CLX) - $10.65

Kinder Morgan Inc (KMI) - $24.19

Procter & Gamble Company (PG) - $9.02

Caterpillar Inc (CAT) - $8.40

Vodafone (VOD) - $9.70

One of my many Goals is to receive $2,000 in dividends for this year.

I am 8.8% complete in reaching my goal. I hope you guys continue to follow my blog and cheer me on to hit is goal of mine.

All of the income that I'm receiving from dividends are all being reinvested. I'm currently reinvesting it all into KMI.

Also, don't forget to check out my Dividend Income page which shows the total income by month.

Was February a good month for you?

February 2014 Dividends Received:

Total dividends for the month of February: $86.85

One of my many Goals is to receive $2,000 in dividends for this year.

I am 8.8% complete in reaching my goal. I hope you guys continue to follow my blog and cheer me on to hit is goal of mine.

All of the income that I'm receiving from dividends are all being reinvested. I'm currently reinvesting it all into KMI.

Also, don't forget to check out my Dividend Income page which shows the total income by month.

Was February a good month for you?

Friday, February 21, 2014

Trade - Buy

I added more shares of Philip Morris International Inc. (PM)

15 shares @ 79.31 on 2-14-2014

This will increase my forward 12-months dividend by $56.40.

I updated my Portfolio to reflect the change

Morningstar (****) Fair: $90.00

S&P Capital IQ (***) Fair: $78.60

15 shares @ 79.31 on 2-14-2014

This will increase my forward 12-months dividend by $56.40.

I updated my Portfolio to reflect the change

Morningstar (****) Fair: $90.00

S&P Capital IQ (***) Fair: $78.60

Wednesday, February 19, 2014

Trade - Buy

I added more shares to Chevron Corporation (CVX)

10 shares @ $112.36 on 2-14-2014

This will increase my forward 12-months dividend by $40.

I updated my Portfolio to reflect the change.

Undervalue with this 15 year graph

Also undervalue with this 4 year graph.

Here you see that the yield is getting up there. It's at its highest in 3 years.

Here is the dividend growth. As you can see it is heading in the right direction.

What do you think of CVX?

10 shares @ $112.36 on 2-14-2014

This will increase my forward 12-months dividend by $40.

I updated my Portfolio to reflect the change.

Undervalue with this 15 year graph

Also undervalue with this 4 year graph.

Here you see that the yield is getting up there. It's at its highest in 3 years.

Here is the dividend growth. As you can see it is heading in the right direction.

What do you think of CVX?

Tuesday, February 18, 2014

FRIP Purchase

I added more shares to my position of Kinder Morgan Inc. (KMI).

2 Share @ $33.72

This increases my forward 12-month dividend income by $3.28 to a total of $1,312.80

I also updated my portfolio page to reflect the change.

What are you buying with your dividends?

2 Share @ $33.72

This increases my forward 12-month dividend income by $3.28 to a total of $1,312.80

I also updated my portfolio page to reflect the change.

What are you buying with your dividends?

Thursday, February 13, 2014

Trade - Buy

I open a new position with Cisco System Inc. (CSCO)

29 shares @ 21.84 on 2-13-2014

This will increase my forward 12-month dividend by 22.04 to a total of $1,210.80

I updated my Portfolio to reflect the change.

As you can see Cisco for the most part of this 15 year graph has been overvalue. Just recently it started to trade under the orange line. Cisco has a Debt/Cap of 16% which is great. It also has a dividend payout ratio of 46% which is great as well.

Here is a 4 year graph and it shows how undervalue Cisco is right now.

Here we have a chart that shows future estimate earnings.

One of my concern is that Cisco just recently started paying out dividends in 2011. As you can see Cisco has been raising its dividends. Cisco just raised its dividends from .17 a share to .19 a share. This is a increase of 11.7%. Since they have a low payout ratio, I see more dividend increases in the future.

Here we have a chart showing the last 5 year of price and dividends. As you see the dividends keeps on rising. This chart does not account the new 11.7% raise that came out today. This tells me that Cisco is undervalue.

What do you think of Cisco? Do you own shares or plan to?

29 shares @ 21.84 on 2-13-2014

This will increase my forward 12-month dividend by 22.04 to a total of $1,210.80

I updated my Portfolio to reflect the change.

As you can see Cisco for the most part of this 15 year graph has been overvalue. Just recently it started to trade under the orange line. Cisco has a Debt/Cap of 16% which is great. It also has a dividend payout ratio of 46% which is great as well.

Here is a 4 year graph and it shows how undervalue Cisco is right now.

Here we have a chart that shows future estimate earnings.

One of my concern is that Cisco just recently started paying out dividends in 2011. As you can see Cisco has been raising its dividends. Cisco just raised its dividends from .17 a share to .19 a share. This is a increase of 11.7%. Since they have a low payout ratio, I see more dividend increases in the future.

Here we have a chart showing the last 5 year of price and dividends. As you see the dividends keeps on rising. This chart does not account the new 11.7% raise that came out today. This tells me that Cisco is undervalue.

Morningstar (4 star out of 5) Fair value of $26.00

S&P Capital IQ (3 star out of 5) Fair Value of $28.20

Monday, February 10, 2014

FRIP Purchase

I added more shares to my position of Kinder Morgan Inc. (KMI).

1 Share @ $33.90 of KMI

This increases my forward 12-month dividend income by $1.64 to a total of $1,189.44

I also updated my portfolio page to reflect the change.

What are you buying with your dividends?

1 Share @ $33.90 of KMI

This increases my forward 12-month dividend income by $1.64 to a total of $1,189.44

I also updated my portfolio page to reflect the change.

What are you buying with your dividends?

Thursday, January 30, 2014

Dividend Income - January 2014

Once a month I will be updating the dividend that I received for that month.

January 2014 Dividends Received:

January 2014 Dividends Received:

- Realty Income Corp. (O) - $4.01

- American Rlty Cap. PPTYS (ARCP) - $9.87

- Wal-Mart Stores (WMT) - $7.52

- Baxter International (BAX) - $16.17

- Altria Group (MO) - $13.92

- Philip Morris Intl (PM) - $26.32

- General Electric Co (GE) - $12.76

Total dividends for the month of January: $90.57

This is a great start to the new year.

One of my many Goals is to receive $2,000 in dividends for this year.

All of the income that I'm getting from dividends are all being reinvested. I am currently reinvesting it all into KMI.

Also, don't forget to check out my Dividend Income page which shows the total income by month.

Was January a good month for you?

This is a great start to the new year.

One of my many Goals is to receive $2,000 in dividends for this year.

All of the income that I'm getting from dividends are all being reinvested. I am currently reinvesting it all into KMI.

Also, don't forget to check out my Dividend Income page which shows the total income by month.

Was January a good month for you?

Saturday, January 25, 2014

Negative Value for my Portfolio...

For the first time in my financial freedom journey my portfolio market value is less then my cost basis value. Ooooh NOOOO!!!!

Take a look Here

Its all good. In the past I would have panic and maybe sold some shares. Now I am happy because this means that I can average down on some of my positions. I brought high quality companies that increase there dividends year in and year out, so this does not worry me one bit. This is why I love DGI!! As long as the company pay dividends and increases the dividends every year, then there is nothing to worry about. All I have to do is just monitor it for any dividend cuts.

The ones that I would like to buy right now to average down are PM, CVX, TGT, ESV, KO, and BAX. They are all great price right now, but I would pick PM first when I get paid this coming Friday.

Some new ones that I would like to add right now because I think the price is right would be TGH, COP, DE, and NSC.

What have you brought recently or plan to buy?

Take a look Here

Its all good. In the past I would have panic and maybe sold some shares. Now I am happy because this means that I can average down on some of my positions. I brought high quality companies that increase there dividends year in and year out, so this does not worry me one bit. This is why I love DGI!! As long as the company pay dividends and increases the dividends every year, then there is nothing to worry about. All I have to do is just monitor it for any dividend cuts.

The ones that I would like to buy right now to average down are PM, CVX, TGT, ESV, KO, and BAX. They are all great price right now, but I would pick PM first when I get paid this coming Friday.

Some new ones that I would like to add right now because I think the price is right would be TGH, COP, DE, and NSC.

What have you brought recently or plan to buy?

Friday, January 17, 2014

Trade - Buy

I added more to my position with Ensco PLC (ESV)

23 shares @ $54.84 on 1-17-2014

This will increase my forward 12-month dividend by $69.00 to a total of $1,189.44

I updated my Portfolio to reflect the changes.

I last posted my ESV buy Here

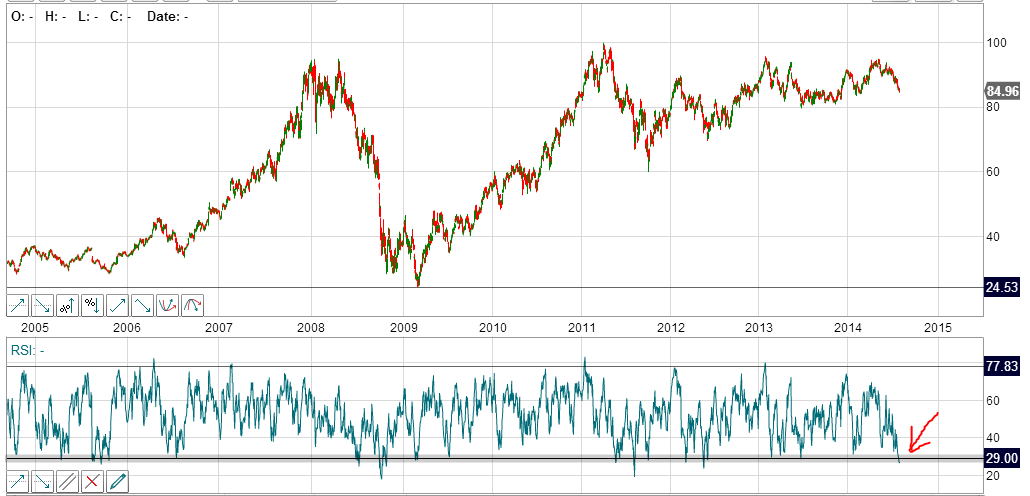

Here you can see that there is a strong support for ESV around the $54 range, and it is almost hitting the trend line. Another thing to look at is the RSI graph. You can see that around the 35 range it bonuses back up. This lead me to believe that it is a good time to buy more shares of ESV.

Here is a 15 year FAST graph. This shows that it is very much undervalue. Notice the Debt/Cap at 27%. Which is very good.

Here is a 4 year FAST graph which shows earnings going up and the price staying much the same.

This is the future estimated earnings and how my current investments may perform in the next 10 years.

My only concern with this company is that it does not have a long history of dividend growth. They do have a nice history of paying dividends with no cuts.

23 shares @ $54.84 on 1-17-2014

This will increase my forward 12-month dividend by $69.00 to a total of $1,189.44

I updated my Portfolio to reflect the changes.

I last posted my ESV buy Here

Here you can see that there is a strong support for ESV around the $54 range, and it is almost hitting the trend line. Another thing to look at is the RSI graph. You can see that around the 35 range it bonuses back up. This lead me to believe that it is a good time to buy more shares of ESV.

Here is a 15 year FAST graph. This shows that it is very much undervalue. Notice the Debt/Cap at 27%. Which is very good.

Here is a 4 year FAST graph which shows earnings going up and the price staying much the same.

This is the future estimated earnings and how my current investments may perform in the next 10 years.

My only concern with this company is that it does not have a long history of dividend growth. They do have a nice history of paying dividends with no cuts.

|

| Graph from http://www.longrundata.com/index.php |

Morningstar (4 star out of 5) Fair value of $70.00

S&P Capital IQ (4 star out of 5) Fair Value of $61.50

Yahoo Finance Target of $62.72

Marketwatch Target of $62.93

What do you think of ESV? Like what you see or don't?

Subscribe to:

Comments (Atom)