15 shares @ $85.10 on 8-1-2014

This will increase my forward 12-months dividend by $36 to a total of $1,704.68

I updated my Portfolio to reflect the change.

Here we see that DE is very much undervalue. We also see that projected EPS is on a downtrend. I am not worry about this because people got to eat. Therefore farmers will need DE.

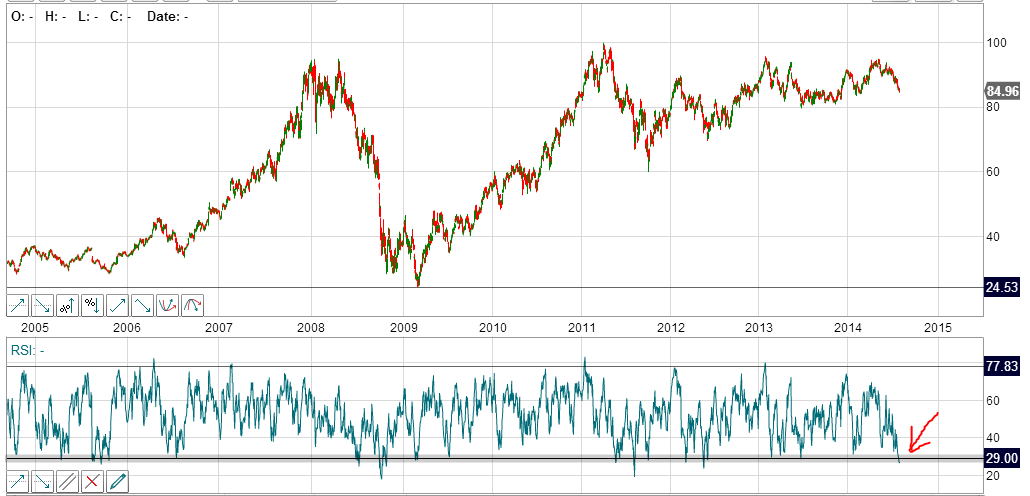

Here is a 5 year graph.

Here we have a 5 year est. tot. ret. of 12.6%

This shows us that DE is oversold with its RSI at 29.

Here we show that the 5 year yield is at the highest point right now.

Here we have the dividend growth.

Morningstar (***) Fair: $95.00

S&P Capital (**) Fair $105.50:

What do you think of DE?

DE valuation lookin very cheap especially with this market dip. Good Buy!

ReplyDeleteI'm looking to add a bit more DE to my portfolio. In hindsight I was way early with my second purchase of DE but it's too late to correct that now. Hoping it drifts a bit lower to let me average down more with just one more purchase then I'll probably have to hold off on adding any more. Nice buy!

ReplyDeleteThanks for sharing your recent analysis and buy of DE. From the dividend blogs, DE has been a popular pick in recent weeks. I know the low PE makes it enticing and in general it is a great long term buy. Nice job. I'm already with CAT and don't want to double up on two similar companies.

ReplyDeleteThanks for writing this

ReplyDelete